FL-140 Form Declaration of Disclosure (Family Law) CA Guidance

Read our blogs to get tips on California uncontested, online, and DIY divorce.

Share

FL-140 Form Declaration of Disclosure (Family Law) CA Guidance

Share

The FL-140 Declaration of Disclosure is an obligatory financial form that must be completed in California divorce cases.

The disclosure requirements in California aim to ensure both parties are fully aware of their income, assets, and debts to allow the court to divide property and calculate support fairly.

You must complete a preliminary and a final disclosure even if your spouse is not participating (default cases).

At The Complete Divorce, we simplify the complexities of this process with our guided software and optional Certified Divorce expert review services.

Our services will save you time and money in online, uncontested divorce while complying with all legal matters.

Check out if you qualify for online divorce in California? If yes, then let our team of experts handle your disclosure paperwork.

Key Takeaways

- Disclosure Requirement: The FL-140 Disclosure Form is required in all California divorces so that spouses are fully transparent about finances, even in cases of default.

- Disclosure is a Two-step Process: Preliminary and Final disclosures must be served on your spouse, and only the proof of service (FL-141) must be filed with the court.

- Accuracy Counts: By providing complete and accurate disclosures, you avoid penalties, delays in your case, and the consequences of reopening future financial issues.

- Special Scenarios: Self-employed individuals, unemployed spouses, and disputed assets require particular attention when preparing disclosures to meet legal standards.

FL-140 (Declaration of Disclosure) Form Purpose & Requirements

The FL-140 Declaration of Disclosure is a required California divorce form that requires full financial disclosure between the spouses. It serves two purposes: to identify all financial assets and liabilities so that marital assets/debts can be equitably divided and to determine spousal/child support.

Even when one spouse does not respond, the FL-140 remains legally required under California Family Code §2100-2113.

The court will require this disclosure process to avoid the potential for hidden assets and to encourage equitable settlements.

If you do not properly complete this requirement, the court can order penalties, potentially including monetary sanctions or setting the case for trial later.

Therefore, both parties in a divorce must complete both preliminary and final disclosures.

Need help with your FL-140? Get in touch with The Complete Divorce today!

When to File the FL-140 Form

In divorce cases in California, the FL-140 Declaration of Disclosure must be completed and served at two important stages.

First is the Preliminary Declaration of Disclosure, which must be exchanged early in the divorce. This provides initial financial transparency between the spouses.

Second is the Final Declaration of Disclosure, which must be completed before the parties reach a settlement agreement or go to trial.

The Final Declaration of Disclosure ensures that all financial disclosures are seen and up to date before settlement or trial.

Do I have to file FL-140?

Yes, California Family law requires all divorcing couples to fill out and exchange an FL-140 Declaration of Disclosure. It doesn’t matter whether you two agree on all complex terms (contested divorce), one spouse does not want to participate in the divorce, or one spouse has a special document on how to divide the property.

You must first disclose all assets in your possession, and this is done to make sure both parties are being fair and transparent.

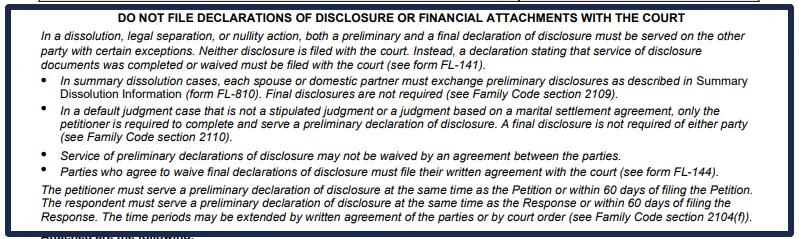

Is Form FL-140 filed with the court?

You do not file the completed FL-140 form with the court. You must serve the disclosure to your spouse, which you can do by mailing it or delivering it to them personally.

You must file an FL-141 Proof of Service form with the court showing that you served your spouse. The court may require that you file certain additional forms depending on what your spouse disclosed, such as FL-142 Schedule of Assets and Debts, and FL-150 Income and Expense Declaration.

What happens if I don’t file the FL-140?

If you fail to file the FL-140 disclosures that are required, there can be severe legal consequences which can also be one reason for an unsuccessful divorce.

The court can sanction you or order you to pay monetary penalties, the court may restrict your ability to receive a divorce, and/or there could be negative rulings regarding the distribution of assets, and support obligations.

In serious circumstances, the court may reverse judgments which have already been finalized, and reopen matters which have been resolved because effective disclosures were not made.

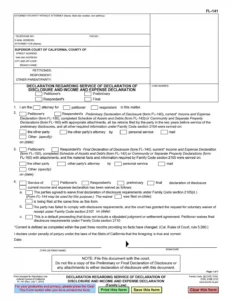

How to Complete the FL-140 Form

Completing the FL-140 properly is important and one of many stages of your divorce. Follow the steps below to ensure you comply with all requirements and avoid costly mistakes.

Step 1: Gather Your Financial Documents

Before completing the FL-140, collect these essential records:

- Recent pay stubs (last 2 months)

- Tax returns (past 2 years)

- Bank and retirement

account statements - Mortgage/loan documents and credit card bills

- Investment records and property deeds

What gets attached? Aside from the first two items on this form (assets/debts) and FL-150 (income/expenses), the other items you want to attach to this are your tax returns, and your statements that cover numbers 4-6.

Pro Tip: Make a spreadsheet to record accounts and debts. It saves a lot of time completing similar forms.

Step 2: Fill Out the FL-140 Form

Begin by completing the top section with your case details:

- Attorney/Party Information: If representing yourself, write “Self-Represented”

- Court Details: Include the full court name, branch, and complete address

- Case Information: Fill in all party names exactly as they appear on your petition

- Case Number: Find this on your court documents

In the Disclosure Type section

✓ Check “Preliminary” for your initial financial disclosure

✓ Check “Final” when submitting complete information before settlement

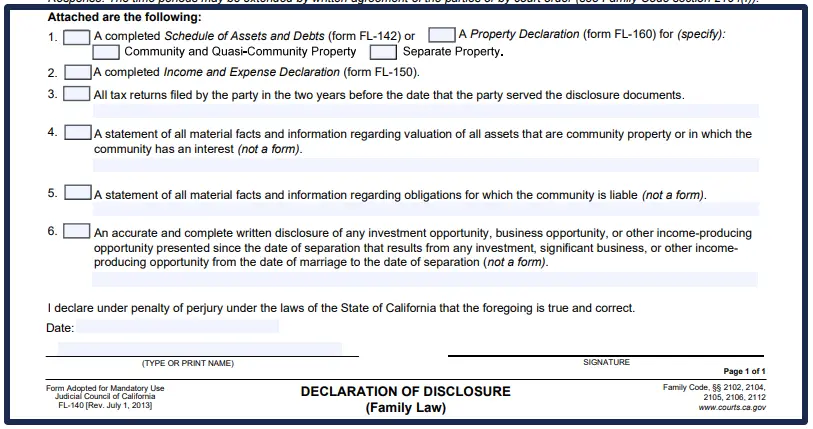

The Attachments section requires you to list all supporting forms being submitted, including:

- FL-142 (Schedule of Assets and Debts)

- FL-150 (Income and Expense Declaration)

Important Notes:

- Never file the FL-140 itself with the court – only serve it to your spouse

- You must file FL-141 (Proof of Service) to confirm delivery

- Sign and date the form under penalty of perjury

Need help completing your disclosure forms correctly? The Complete Divorce can help make it easier!

Step 3: Complete Supporting Forms

The FL-140 requires several additional forms to disclose your financial situation fully:

- FL-141 (Proof of Service): Documents that you properly served your disclosure to your spouse.

- FL-142 (Schedule of Assets and Debts): Lists all property, accounts, loans, and financial obligations.

- FL-150 (Income and Expense Declaration): Details monthly income, living costs, and support calculations.

- FL-160 (Property Declaration): Required for complex property divisions or business interests.

- FL-180 (Child Support Information): Needed if child support is being determined, especially when getting a divorce while pregnant in California.

Each form serves a specific purpose in your financial disclosure.

Step 4: Serving the Disclosure Properly

In California, you have to serve your completed FL-140 and all supporting documents to your spouse (not the court) and your method of service can be direct, either by certified mail, with return receipt requested, or personal delivery by a neutral third party or through an attorney.

After serving your spouse, you must file Form FL-141 (Proof of Service) with the court to prove you complied with the statute.

The Complete Divorce’s service ensures your disclosures are served accurately to your spouse and that all paperwork is correctly completed.

Let our team take care of the service process for you.

Step 5: Verify Your Spouse's Compliance

Under California law, each spouse must exchange complete financial disclosures. After properly serving your FL-140, be sure your spouse meets their 60-day deadline to reciprocate.

If your spouse doesn’t file or properly serve their disclosures, you may file a Motion to Compel (Form FL-300) and ask the Court for intervention, including sanctions.

Divorce Expert Reveals What Mistakes People Make with FL 140 and How to Avoid Them?

Completing the FL-140 correctly reduces hiccups and helps you finalize your divorce on time.

Many people make errors that set their cases back or cause legal penalties. Below are the most frequent mistakes and how to prevent them.

Mistake 1: Omitting Assets or Debts

If you fail to disclose all financial accounts, properties, or debts intentionally or unnaturally, you will receive court penalties, fines, or (the worst) the court will reopen your division.

When filling out the FL-140, review bank statements, credit reports, and loan documents, and merge your findings from the past several years to check that you have not missed anything.

Mistake 2: Incorrect Income or Expense Reporting

If you underreport income or expenses, you may alter the support calculations, resulting in unfair findings.

Use current pay stubs or leave statements from your employer and include your most recent tax returns and receipts to substantiate any figures you report whenever possible.

If an expense is split (e.g. rent, utilities), specify who paid what to show what is actually spent.

Mistake 3: Missing Deadlines

California has strict deadlines for preliminary and final disclosures. If you file late, it will only delay your divorce or may even get your case dismissed.

Mark these dates on your calendar and check with the court’s self-help center if unclear.

Mistake 4: Improper Service

If you serve the documents incorrectly (for example, mailing them without proof of delivery), you have not complied with California law.

California allows certified mail, personal service handing it directly to the other party by a neutral party, or attorney service. After serving the documents, you will always file FL-141 (Proof of Service).

Contact The Complete Divorce today if you need help avoiding these errors!

FL-140 and Special Scenarios in California

Completing the FL-140 process may not always be simple. Some situations may require extra care to avoid violation.

Below are solutions to some of the common, complicated scenarios.

1. Correcting Mistakes in Your FL-140

If you realize there is an error in your disclosure after it has been served, you can file an amended FL-140.

You will fill out a new form with the corrected information, mark it “Amended” at the top of each page, and serve it to your spouse.

2. Unemployed or Low-Income Reporting

If you do not have any income, still report “$0” and indicate how you may be getting support if applicable (i.e. lived rent-free or spouse pays living expenses).

Attach any verification of public assistance, if applicable. If you were just hired, use pay stubs for the past three months, and attach pay stubs that show the most recent earning history.

3. Self-Employment Documentation

These include:

- Year-to-date profit/loss statements

- 2 years of tax returns (with Schedule C)

- Client payment records or 1099s

A CPA can help categorize deductible expenses properly.

4. Disputed Assets

In the case of jointly owned assets with no clear division (for example, family businesses):

- List the asset in FL-142 at its full value

- Note “ownership disputed” in the description

- Attach any appraisals or partnership agreements.

The court will divide the assets during proceedings.

5. Non-Responsive Spouses

If your spouse refuses to disclose:

- Send a formal request via certified mail

- File FL-300 (Motion to Compel) after 30 days

- Request sanctions for non-compliance

For more guidance on how to navigate your unique FL-140 scenario, contact The Complete Divorce!

How The Complete Divorce Helps You With FL-140 & Divorce

Completing the FL-140 isn’t straightforward and may require professional guidance. Fortunately, under the lead of divorce expert Dina Haddad, The Complete Divorce can help you navigate this process and your divorce at a fraction of the price of hiring an attorney.

The Complete Divorce’s easy-to-use software guides you to disclose financial information while protecting sensitive data accurately.

We will even point out what data you have to share and what you can protect as completely confidential.

For additional safety, we recommend only sharing the legally required information, using our secure document exchange system.

We ensure your disclosures will meet all legal requirements while maximizing privacy protections during your divorce.

Get Expert FL-140 Assistance Today! Contact The Complete Divorce.

‘The Complete Divorce’ Simplifies Your Divorce

The FL-140 is a big requirement in California divorces. Its goal is to ensure fair financial disclosure in divorce between spouses.

Proper preparation and strict compliance with the rules will prevent delays and possible penalties.

With The Complete Divorce’s DIY Divorce Program, you will be walked through every step of the process from home, making it easy, cheaper, and stress-free to fill out the FL-140.

Start Your Divorce Online Today!

FAQ

1. Does FL-141 need to be served?

No. FL-141 (Proof of Service) is filed with the court to confirm you served your FL-140 disclosure to your spouse.

2. FL-140 vs FL-141 difference?

FL-140 contains financial disclosures. FL-141 proves you served those documents. Both are required but serve different purposes.

3. What is a declaration of service of disclosure?

It’s the FL-141 form, which documents when/how you delivered financial disclosures to your spouse and is required for court records.

Reviewed By:

I’m Dina Haddad, a family law attorney-mediator in California. I’m so tired of couples not having a process that’s easy to complete their divorce. They are getting lost, wasting time and money, and beyond frustrated with their results.That’s why I created TheCompleteDivorce. I took my successful mediation practice and condensed it into an affordable and winning program.