Declaration Regarding Service of Declaration of Disclosure and Income and Expenses Declaration (FL-141)

Read our blogs to get tips on California uncontested, online, and DIY divorce.

Share

FL-141 (Family Law) California Guidance

Share

In California divorces, FL-141 Declaration Regarding Service of Declaration of Disclosure provides legal evidence that you shared your financial information with your spouse.

The form tells the court that the party has complied with the disclosure requirements.

This form is required for everyone, whether you filed a divorce (petitioner), are responding to divorce papers (respondent), or do not have an attorney. Everyone must complete one (with very limited exceptions explained below).

The court requires this form to ensure that both spouses are completely financially transparent with one another prior to the divorce. If you fail to properly complete and submit FL-141, you may face serious consequences that include wasted time in your proceedings, the court fining you, or issues dividing property.

At The Complete Divorce (TCD), we make this process easier by providing the software (so you can easily complete the FL-141 and any other divorce forms without the expense of hiring a lawyer) and Certified divorce expert services to make sure that your divorce remains smooth. Check out If you ‘Qualify for Uncontested Online Divorce in California?’ Visit “The Complete Divorce today”.

What Is the FL-141 Form?

Form FL-141, formally known as the Declaration Regarding Service of Declaration of Disclosure and Income and Expense Declaration, is an important part of California divorce filings.

This document is a sworn verification that you have served financial disclosures, which include the following:

- FL-140 (Declaration of Disclosure)

- FL-150 (Income and Expense Declaration)

- FL-142/FL-160 (Schedule of Assets and Debts)

All required by law to be served to your spouse.

Purpose of Form FL-141

The FL-141 is a necessary and legal document contained in California Family Code §§ 2100-2113 that requires divorcing spouses to provide full disclosures of their finances.

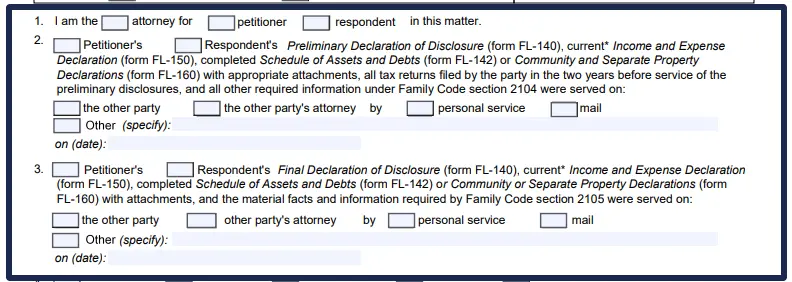

This means that either preliminary disclosures were exchanged (earliest in the case) or final disclosures were exchanged (before judgment).

This form will become part of the official record of the court, and it will likely become part of the judgment packet you will submit in the final divorce paperwork to the judge for approval.

Why Is the FL-141 Form Important?

The FL-141 form is important in California divorces because it legally shows that both parties exchanged complete financial information.

Even if you do not believe you have any assets or debts to disclose, you must still submit FL-141.

California law requires the transparency portrayed by FL-141 in all divorces to ensure an equitable process.

This ensures that the parties do not later learn of assets and debts that were simply hidden from each other.

What If You Don’t File FL-141 in 60 Days?

You must file FL-141 within 60 days from when you served your disclosures, failure to do so may result in serious effects. Depending on the length of the delay, your case will be sanctioned by the court, your divorce case may be delayed, or the other party could be granted attorney fees to compensate for your transgressions.

However, this only happens if your spouse files an action that you did not comply with the rules (and your spouse complied).

If the party does not file the FL-141, you may have to file a motion to compel the other party’s disclosure, which only lengthens the divorce process and incurs additional costs.

If you file FL-141, you are both protected against the risk of disputes regarding asset division and show the court that you did comply.

A mistake or omission on your disclosures could result in penalties from the court, substantial financial liabilities imposed upon you, and (especially if there are subsequently discovered assets that were hidden) the reopening of a settled case.

The Step-by-Step Guide to Completing the FL-141 Form

Filling out Form FL-141 correctly ensures your financial disclosures are properly documented with the court. Such proper filing is one of the key steps for a successful divorce in California.

You cannot use one FL-141 for both parties. You also cannot use one FL-141 for both your preliminary and final declarations of disclosures. In other words, do not mark both preliminary and final on the same form.

The only time that a party is not required to do both is if they are proceeding by default or the parties jointly waive their final declarations of disclosures.

Follow these steps carefully to avoid delays or penalties.

Step 1: Gather Required Documents

For preliminary disclosures, you’ll need:

- FL-140 (Declaration of Disclosure): Basic financial overview.

- FL-150 (Income and Expense Declaration): Income, expenses, and pay stubs.

- FL-142 or FL-160 (Assets and Debts): Detailed property and debt listings.

- Tax returns: Attach the last two years for preliminary disclosures.

For final disclosures, provide updated versions of the above (unless waived via FL-144) along with proof of service and any relevant tax documents.

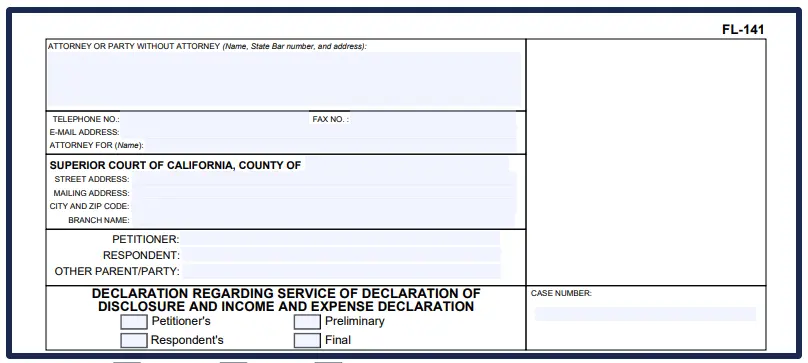

Step 2: Fill Out the Header

Fill in the court’s name, address and your case number. Write whether you are the petitioner or the respondent, and check whether you are filing preliminary or final disclosures.

Step 3: Complete Section 1 (Service Declaration)

List all forms (FL-140, FL-150, etc.) served, dates served, and means of service (i.e., by mail or by personal delivery). If the disclosures were preliminary, you will need to attach tax returns.

Step 4: Address Section 4 (Waivers, If Applicable)

If you waived final disclosures (via FL-144 or a default judgment), check the appropriate box. Sign and date the form under penalty of perjury.

Step 5: Serve and File

Finalize the process by serving your spouse by mail or personal service. Then, file the original FL-141 with the court by mail (with a self-addressed stamped envelope) or e-file via your county’s e-filing system.

Note: You can mail the FL-141 to the court, but check your local rules as some courts prefer e-filing. To e-file, check your local county court website and take appropriate steps to follow its e-filing process.

FL 141: Common Mistakes to Avoid

Avoid costly mistakes on your FL-141—whether improper service, missing dates, or missed deadlines—that can make your separation take longer than the normal divorce timeline in California or result in additional penalties. Here are some mistakes to avoid:

1. Improper Service Methods

Never serve any disclosures via email/text unless expressly consented to in writing. Only use certified mail, personal means of delivery, or a process server. Our system also verifies acceptable service methods by your county, so you do not risk rejection.

2. Missing Dates/Signatures

The FL-141 requires the service to include the dates and your signature under penalty of perjury. If the dates and signature are not completed, the FL-141 must be considered void. Our system provides you with all the required fields and reminders for stages needing a notary.

3. Not including tax returns

The preliminary disclosures require two signed copies of tax returns. Forgetting tax returns will trigger automatic rejection. We have a checklist of all attachments, and we flag what is missing before submission.

4. Incorrect filing of disclosure forms

FL-140/FL-142 only goes to your spouse, not the court. We’ll identify which forms need to be filed and served to prevent this common clerical error from happening.

5. Late Filing

Missing the 60-day deadline can result in a sanction. If you are late, you should file as soon as possible. Our deadline tracker sends out alerts 30/15/3-day advance notices to comply on time.

6. Ignoring waivers

Always properly document waivers (FL-144), whether in default or uncontested cases. Our interview process automatically generates waiver forms when applicable.

Consequences of Not Avoiding Mistakes in FL-141

Errors in your FL-141 can derail your divorce plan and lead to serious consequences. If the errors are repeated, courts can treat them as contempt of court and rule against you on asset division.

Fortunately, our platform protects you against filing errors via automated error detection, real-time court rules, and attorney-reviewed documents, so you can eliminate this risk and go through the stages of divorce with ease.

FL-141: Special Cases & Scenarios in California Divorce

While the FL-141 process is usually straightforward, some rare divorce cases require specialized attention from you.

Whether you are waiving disclosures, facing an unresponsive spouse, or dealing with late filings, you need to ensure that you are aware of court rules in these situations.

1. Waiving Final Disclosures

In certain divorce cases, you may have to handle the FL-141 forms differently. If you and your spouse have agreed to waive final disclosures, you should use Form FL-144 to document this agreement.

However, please be aware that waiving disclosures can lead to future disputes if undisclosed properties are revealed in the future.

2. Default or Uncontested Divorces

In a default or uncontested case, you have to file the preliminary FL-141 even if your spouse has failed to respond.

Depending on the divorce case, final disclosures may be waived, but always check with the Court first. Preliminary disclosures can never be waived – they are required for every divorce in California.

3. Late Filing or Non-Compliant Spouses

If you are filing an FL-141 late, submit your FL-141 as soon as you are able to do it.

If your spouse has chosen not to file it, then you may need to file a motion to compel the disclosure or seek discovery to obtain the financial information. The court can sanction non-compliant spouses.

Simplify Forms Filling & Filing. Simplify Your Divorce

The FL-141 form is essential for documenting financial disclosures in your California divorce. By going through the steps carefully, you avoid hefty delays and potential penalties.

For a seamless process, check out TCD’s guided DIY divorce service that can get you through your forms in a proper and timely manner.

Check out If you ‘Qualify for Uncontested Online Divorce in California?’ Visit “The Complete Divorce today”.

FAQ

1. Does FL-141 need to be served?

No. The FL-141 itself does not require service to your spouse, like a financial disclosure form does. What you need to do is file the completed form with the court, after serving your financial disclosures (FL-140, FL-150, etc.) to your spouse.

2. What's the difference between FL-140 and FL-141?

For the FL-140, it acts as a cover sheet to your disclosure documents and states that the party verifies that their disclosures are accurate.

In the FL-141, the party is conforming to the court that they have served those disclosures to their spouse.

You can think of FL-140 as the cover sheet to the financial report and FL-141 as the proof that it was done.

3. How do I know if my FL-141 was accepted?

The court normally doesn’t send confirmation. To verify acceptance:

- Check your case status online via the court’s e-filing portal

- Look for the filed stamp if you submit in person

- Watch for correspondence from the court about any deficiencies

Your final judgment packet will mention it if it was properly filed.

Reviewed By:

I’m Dina Haddad, a family law attorney-mediator in California. I’m so tired of couples not having a process that’s easy to complete their divorce. They are getting lost, wasting time and money, and beyond frustrated with their results.That’s why I created TheCompleteDivorce. I took my successful mediation practice and condensed it into an affordable and winning program.